TSMFC Telangana Minority Loan Scheme:- All the minority community members of Telangana state who want to apply for the Minority Loan scheme can apply for the loan because the application form is accepted under the Economic Support Scheme for (Bank Linked & Non-Bank Linked). The starting date to apply for the loan is 19 December and the last date to apply for the loan is 9th January 2023. Before the deadline, you can apply for a business loan. Interested and eligible candidates can apply for the loan by visiting the official website.

In this article, we will let you know about the TSMFC Telangana Minority Loan Scheme, its key highlights, its objective to launch, its features & benefits, eligibility criteria to apply, documents required & procedures to apply. So, read the full article and if you still have any doubts you can comment below we will try to solve it as soon as possible.

Table of Contents

About Telangana Minority Loan Scheme

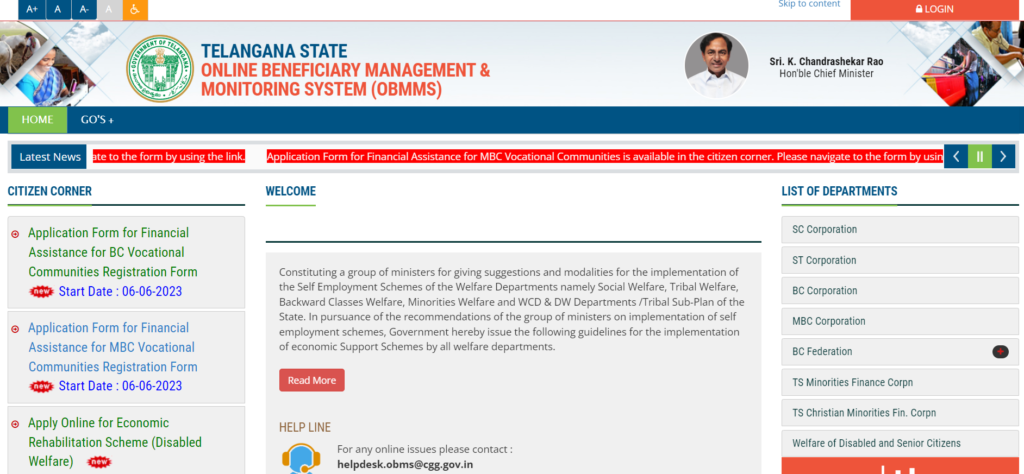

TSMFC Telangana Minority Loan Scheme was started by the Chief Minister of Telangana Mr. K. Chandrashekhar Rao. In this scheme government is providing two types of loan schemes to the minorities to start their own business: a Loan of Rs. 1 lakh with a subsidy of 80% and another Loan of Rs. 2 lahks with a 70% subsidy. More than 1.5 lakh minority community members can benefit from this scheme. You can apply for the loan by filling out an online form or by visiting the MPDO Office, District Office. Only BPL families who own white ration cards can take the subsidy loans. Online Beneficiary Management and Monitoring System (OBMMS) asked everyone to take the benefit of this amazing scheme.

Minority Loan Scheme Telangana Key Highlights

| Scheme name | TSMFC Telangana Minority Loan Scheme |

| Started by | Telangana Government |

| Launched by | Chief Minister of Telangana Mr. K. Chandrashekhar Rao |

| Loan Amount | Rs. 1-2 Lakhs |

| Year | 2023 |

| Beneficiaries | Minority Community member |

| Scheme Level | National |

| Application procedure | Online/Offline |

| Official website | https://tsmfc.in |

TSMFC Telangana Minority Loan Scheme Objective

The main objective of this scheme is to provide subsidized loans to the minority community so that they can start their own business and provide employment opportunities to the people and it will also raise the living standard of the minority community. And make them economically strong. In this scheme, you can take two types of loan.

Minority Loan Scheme Features And Benefits

- TSMFC Telangana Minority Loan Scheme was started by the Chief Minister of Telangana Mr. K. Chandrashekhar Rao.

- In this scheme, the government is providing loans to minority communities such as Muslims, Sikhs, Parsis, Buddhists, and Jains.

- In this scheme government is providing two types of loan scheme to the minorities to start their own business: a Loan of Rs. 1 lakhs with a subsidy of 80% and another Loan of Rs. 2 lakhs with a 70% subsidy.

- More than 1.5 lakhs minority community member can take the benefit of this scheme. You can apply for the loan by filling an online form or by visiting the MPDO Office, District Office.

- Only BPL families who own white ration card can take the subsidy loans.

- Online Beneficiary Management and Monitoring System (OBMMS) asked everyone to take the benefit of this amazing scheme.

- The main objective of this scheme is to provide subsidized loan to the minority community so that they can start their own business and provide employment opportunity to the people and it will also raise the living standard of minority community.

Telangana Ayushman Bharat Scheme

Eligibility Criteria

- Applicant must be the permanent domicile of Telangana state.

- Only the candidates of aged 21 to 55 years can apply for the loans.

- Only minority community members can apply for the loans.

- The annual family income of the applicant family should not be more than 1.5 lakhs.

Documents Required

- Aadhaar card.

- Domicile Certificate

- Passport-size photographs

- Income certificate

- Mobile number

- Email Id

- Bank Account Passbook first page containing Account Number, Bank Name, Branch Name and IFSC Code.

- If Aadhaar is not available, then Bonafide student certificate from Institute / School and Aadhaar Enrolment ID and Scanned copy of Bank passbook.

Interest Rate Of Telangana Minority Loan Scheme

The interest rate charges by the Telangana State Minorities Finance and Development Corporation is low as compared to other finance institution. Beneficiaries have to pay the interest of 6% per annum on the loans amount of Rs. 1 lakhs and if anyone take a loan of Rs. 2 lakhs than they have to pay a interest of 7% per year. The subsidy rates are 80% for loans upto Rs. 1 lakhs and 70% for loans upto 2 lakhs. This means the beneficiary have to repay only 20% and 30% of the loan amount. It make easier for them to repay the loan without facing any financial problems.

Procedure To Apply For The TSMFC Telangana Minority Loan Scheme

Follow below steps to apply for the loan.

- Firstly, You have to visit the official website.

- On homepage click on Apply Online For Economic Support Scheme (Minorities Finance Corporation- 2022-22).

- A new page will open. Click on Economic Support Scheme Beneficiary Registration link.

- The application form will open on the screen.

- Now fill the application form by entering details such as name, father’s name and Aadhaar number etc.

- After this click on Go button.

Procedure To Check Minority Finance Corporation Loan Status

- Firstly, You have to visit the official website.

- On homepage click on Beneficiary Search option.

- Now Select Corporation.

- After this enter the Beneficiary Id, Date of Birth, Income certificate Number.

- Click on get details icon to check the status.

Frequently Asked Questions (FAQs) About Telangana Minority Loan Scheme

Ans 1- Minority community such as Muslims, Sikhs, Parsis, Buddhists and Jains.

Ans 2- The main objective of this scheme is to provide subsidized loan.