Post Office Monthly Income Scheme:- The post office from time to time brings different types of schemes for securing the post-retirement life of the people. One of these schemes is the Post Office Monthly Income Scheme. In this scheme, the investors have to make only one-time investments to get the monthly benefit. In this article today we will share with you all the important information related to the Post Office Monthly Income Scheme 2024 such as eligibility criteria, important documents, and application procedure. Read an article till the end to grab each and every piece of information.

Table of Contents

Post Office Monthly Income Scheme 2024

A new scheme has been created by the Indian post office in order to provide a better post-retirement life to investors. Under this scheme, the people need to invest a lump sum amount only at once and they will start getting a monthly pension of Rs. 3,300. Under the Post Office Monthly Income Scheme, the maturity benefit will also be provided to the people of the state. The main aim of launching this scheme is to provide a better future for the people after retirement. It is also providing a 6.6 annual interest on the investment.

- To avail of the benefit of the Monthly Income Scheme, investors can invest multiples of Rs. 100 and Rs. 1000.

- The more amount you will invest and it will give you the more pensions per month.

- All interested applicants who want to avail the benefit of POMIS will have to visit the official website of Indian Post Office

Post Office Monthly Income Scheme Details

The details of POMIS are as follows:-

| Name of the scheme | Post Office Monthly Income Scheme |

| Launched by | Indian Post Office |

| Beneficiaries | People of India |

| Objective | To provide better post-retirement life |

| Benefit | A monthly pension will be provided to the retired people |

| Annual interest | 6.6% |

| Monthly Pension | Rs. 3,300 with Rs. 50,000 investment |

| Maturity Periods | 5 years |

| Mode of Application | Online/ Offline |

| Official website | www.indiapost.gov.in |

Monthly Income Scheme 2024 Objective

As we all know there are many people who are planning for their retirement in order to live their life stress-free. And to provide them with better post-retirement life, the Indian Post offers a new scheme to the people known as the Monthly Income Scheme Post Office. Under this scheme, the investor has to invest a lump sum amount at once. After investing the amount, they will get a monthly pension of Rs. 3,3000 during their retired life. The main objective of launching this scheme is to secure the future of people by providing them with a better retirement plan.

- Under this scheme, people will also get a 6.6 % annual interest on the investment.

- The main objective of launching POMIS is to safely invest money for a better monthly pension plan.

- It will help in securing the future of the residents of India.

Credit Guarantee Scheme for Startups

Monthly Pension Amount Under POMIS

A new scheme has been created by the Indian post in order to provide a better future to the retired people of the country. Under the Monthly Income Scheme, if a person makes an investment of Rs. 50,000, then after the maturity period of 5 years they will receive a monthly pension of Rs. 3,300. Also, during these five years, the investor will also receive an interest amount of Rs. 16500. If a person makes an investment of Rs. 1 lakhs under this scheme, then they are liable to get Rs. 6,600 as an early pension and Rs. 550 per month.

- This is one of the best long term investment plans for good return on retirement.

- People don’t need to invest a monthly amount to avail the benefit of the Post Office Monthly Income Scheme.

Investment Under Post Office Monthly Income Scheme

To take the benefit of MIS, people need to invest a lump sum amount at once with a minimum multiple of Rs. 100 and Rs. 1000. Also, the person can invest a maximum amount of Rs. 4.50 lakh in a single account and Rs. 9 lakhs in a joint account. The person can invest an equal share of the amount in case of a joint account under the Monthly Income Scheme. But the liable person cannot invest more than Rs. 4.50 lakh in the account opened by an individual person. The limit for accounts open on behalf of minors shall be separated by the guardian.

- 3 investors can open a joint account under this scheme to avail the benefit.

- People under POMIS, can make minimum investment up to Rs. 100 and maximum investment of upto Rs. 9 lakhs.

POMIS Interest Rate

The Indian post office has come up with a new scheme in order to provide a monthly pension with only a one-time investment. Under Post Office Monthly Income Scheme, interest will be payable on the completion of a month from the starting date till the maturity one. Every month account holders have to claim for interest payable. If they didn’t claim for such interest then the additional interest will not be provided to them. If in case the account holder made an excess deposit then this deposit will be refunded back and only the savings account interest will be applicable. Interest can be drawn through the auto credit option in the savings bank account at the same post office.

- In the case of a monthly income scheme at csb post office, the interest can be credited into the savings bank account.

- The interest under POMIS is taxable in the hands of the depositor.

अटल बीमित व्यक्ति कल्याण योजना

Maturity Of Monthly Income Scheme

The maturity of the Post Office Monthly Income Scheme is about five years. The account may be closed on the expiry of five years from the date of opening if you submit a prescribed application form with the passbook at your nearest post office. In some cases, the account holder dies then the maturity account may be closed and the amount will be refunded to the nominee. No amount will be drawn before the expiry of the account. If the account is closed after 1 year and before 3 years from the date of opening the deduction is equal to 2% from the principal.

- If the account is closed after 3 years and before 5 years deduction is equal to 1% from the principal.

- The account can be prematurely closed by submitting the application form with a passbook at the concerned office.

Post Office Monthly Income Scheme Benefits

The benefits of this scheme are given here:-

- The post office has launched a new scheme to provide best long term investment for the safe and secure future.

- It is a one time investment scheme in which you will get a monthly pension after retirement.

- People don’t need to invest every month under Post Office Monthly Income Scheme.

- They only have to put a lump sum amount by which they can avail the maturity benefit after retirement.

- The scheme is offering 6.6 annual interest to avail the maximum benefit.

- People can make an investment of minimum Rs. 1000 and a maximum of Rs. 9 lakhs.

- Only the joint account holder can do the maximum investment.

- Under POMIS, by investing Rs. 50,000 people can get an annual pension of Rs. 3,300 after retirement.

- People can only withdraw their deposit before one year from the date of deposit.

Post Office Monthly Income Scheme Features

The features of this scheme are as follows:-

- Post office has been a new scheme for the security of the post retirement life for the people.

- Under this scheme the investor has to make only one time investment to get the monthly benefit.

- People have to make an investment of a lump sum amount at once and they will start getting a pension of Rs. 3,300.

- With the help of POMIS, people will be able to live their stress-free after retirement.

- This scheme is providing a 6.6% interest on the investment.

- People have to make an investment of the multiples of Rs. 100 and Rs. 1000

- Also they will be able to with you their deposit one year from the date of deposit.

- If the account is closed after one year and after 3 year then the deduction amount will be equal to 2% from the principal.

- If the account holder dies before maturity the account will be closed and the amount will be transferred to the nominee.

- Interest will be paid on the basis of the preceding month in which they will get a return.

- All the interested applicants who want to make their future secure can apply under Post Office Monthly Income Scheme without hesitating.

- All you have to do is visit the post office’s official website. And download the form for related schemes.

- Download the form and submit it to your nearest post office to get the benefit of this scheme.

Eligibility Criteria

Following eligibility criteria is required to avail the benefits of the scheme:-

- An applicant must be a single adult.

- People can open a joint account up to 3 adults or Joint A or Joint B

- An adult can take a benefit on behalf of minor for person of unsound mind

- The age of the applicant should be 10 years or above.

- He or she must be a resident of India.

Important Documents

Some of the basic documents to apply under this scheme are as follows:-

- Aadhar card

- Bank account details

- Age certificate

- Income certificate

- Passport size photograph

- Mobile number

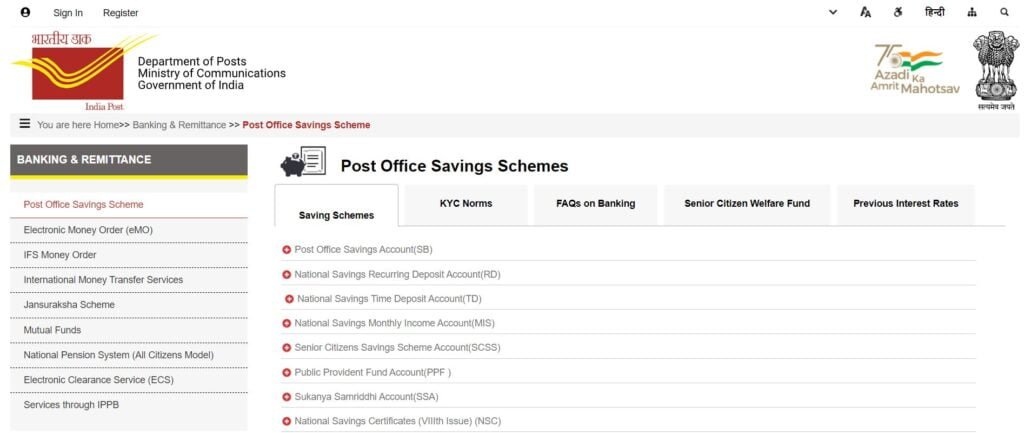

Process To Apply For Post Office Monthly Income Scheme 2024

All the interested applicants who want to apply under the scheme will have to follow the steps mentioned below:-

- To Apply For Post Office Monthly Income Scheme, visit the Official Website of India Post Office.

- You will land on the homepage.

- On the homepage, click on the option of Monthly Income Scheme

- The details related to the scheme will appear on your screen.

- Click on the option of Forms Available

- The list of forms will appear before you.

- Choose the form according to your requirement.

- Download it and enter all your details

- After that attach all your important documents.

- Now submit it to the post office to avail the benefit of this scheme.