Apply Online Recovery Loan Scheme | New Business Recovery Loan Scheme | UK Recovery Loan Scheme | RLS Apply Online |

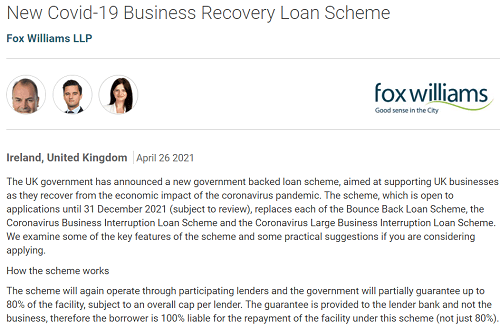

To help the businesses who got affected by the pandemic of covid-19, the UK government has launched a new scheme known as New Covid-19 Business Recovery Loan Scheme. Under this scheme, the facilities will be given to the businessman for business purposes like managing cash flow investment and growth. In this article today we will share with you all the important information related to Business Recovery Loan Scheme (RLS) 2024 such as the objective, eligibility criteria, benefits and features, and important documents. Also, we will share with you all this step by step application procedures to apply under this scheme.

Table of Contents

Business Recovery Loan Scheme

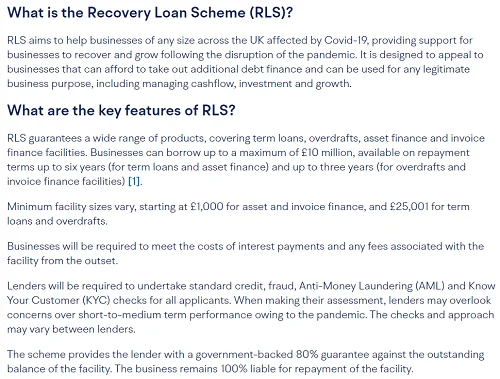

A new scheme has been created by the UK Government to support the businesses that got affected by the pandemic of covid-19. With the help of the New Recovery Loan Scheme, the facilities will be provided to the business owners like managing cash flow, investments, and further growth. This scheme is mainly designed to support the businesses who already afford the cost of the facilities which are mentioned above

- RLS will replace each of the bounce bank loan schemes, coronavirus business interruption loan scheme, and coronavirus large business interruption loan scheme.

- All the interested businessmen who want to avail the benefit under New Covid-19 Business Recovery Loan Scheme can visit their finance provider Bank.

Accreditation Of Finance Under RLS

As we all know the UK government has recently created a business recovery loan to support the small businesses in the UK. Now the accreditation of Finance is given under the recovery loan scheme. The funding circle claims that the Business Recovery Loan Scheme plays an important role in supporting small businesses during Covid 19. Now, CG Business finance will provide the loan of up to £25,001 to £1,00,000 to the small businessman in Manchester who presently do not have access to their regular finance provider

- This will provide wider support to the small businessman to create growth in the business

- CG Business Finance has become the first lender in the UK to support small businesses.

Details Of New Covid-19 Business Recovery Loan Scheme

The details of this scheme are as follows:-

| Name of the scheme | Business Recovery Loan Scheme (RLS) |

| Launched by | The government of the United Kingdom |

| Country | United Kingdom |

| Beneficiaries | UK businessman |

| Objective | To help businesses that are affected by covid-19 |

| Benefits | Facilities related to businesses will be provided |

| Facilities like | Managing Cash Flow, Investment, and Growth |

| Last date to apply | 31st December 2021 |

| First date to apply | 6th April 2021 |

| Mode of Application | Offline |

Business Recovery Loan Scheme Objective

As we all know due to the pandemic of covid-19 many businesses all around the world have been affected which results in a drop-down rate of the business. By keeping this in mind the UK government has launched a new scheme known as Business Recovery Loan Scheme. Under RLS, the loan will be provided to the businesses to bring positive change in the business world.

- The main aim of launching this is to support UK businesses as they recover from the impact of the covid-19 pandemic.

- Along with that another main purpose of launching the UK Recovery Loan Scheme is to provide the facilities among the businesses for other purposes like managing cash flow investment and growth.

Implementation Of Business Recovery Loan Scheme

The implementation of this scheme is dependent on the participating lenders and the government. The government and the participating lenders will be responsible for the partial guarantee of up to 80% of the facilities. Has the guarantee for the loan will be granted to the lenders, not to the businesses.

- Because the borrower is 100% liable for the repayment of the Facilities

- With the implementation of the Business Recovery Loan Scheme, the economy of the united kingdom increased after the pandemic.

- It will help in gaining the facilities like managing cash flow investment and growth

- It will also support the one who can afford the cost of these facilities for the further improvement in their businesses

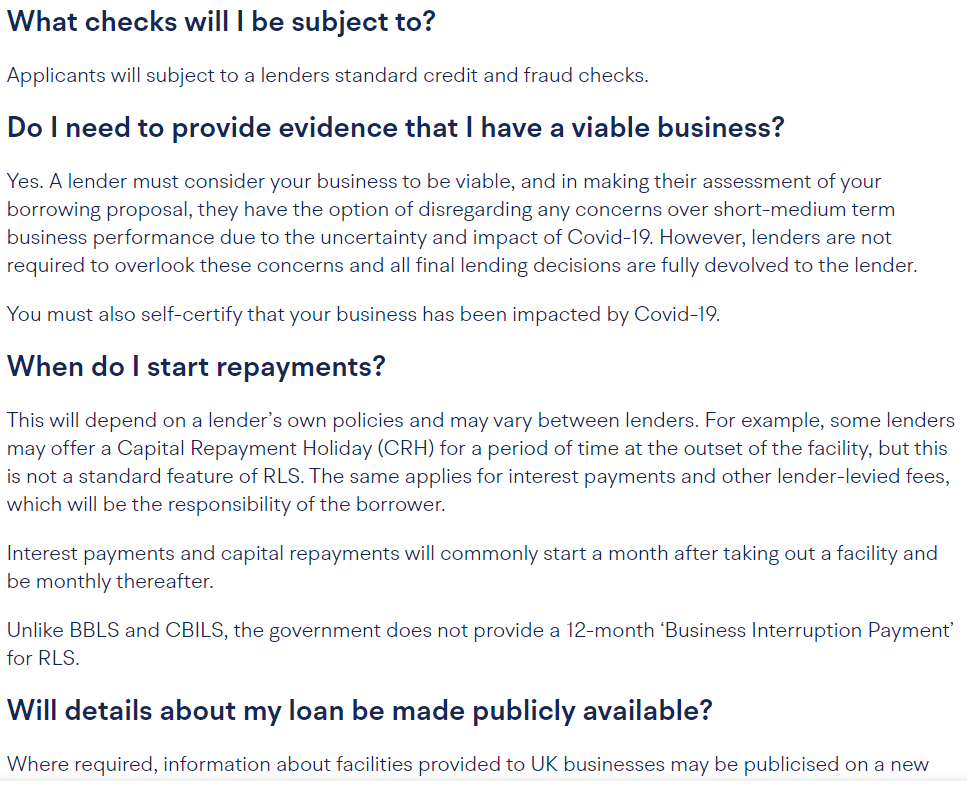

Facilities Under RLS

The New Recovery Loan Scheme will cover all the facilities that are starting with amounts of £1,000 to £30 million for individuals and the groups. Such facilities are mentioned below

- Overdrafts

- Term loans

- Invoice Finance

- Asset Finance

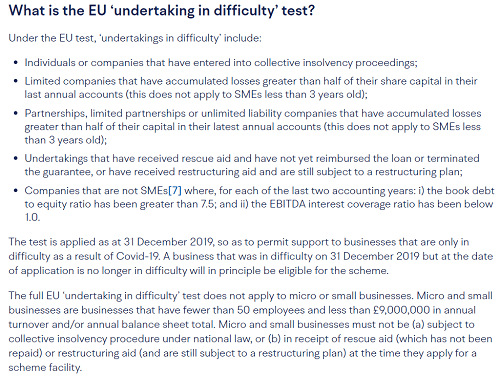

Repaying Of Recovery Loan

After getting the recovery loan, the repayment process will start straight by getting the loan. It will be up to your choice that in how much time you have to repay the loan. The repayment of the loan will be dependent upon the type of finance you took from the Business Recovery Loan Scheme. This loan is quite different from the bounce bike loan where the borrower has to make payment after the first 12 months

Types Of Coronavirus Loan Scheme

There are three types of loan schemes that offer loans to businesses during the pandemic of covid-19. Such schemes are mentioned below

- Bounce Back Loan Scheme

- The Coronavirus Business Interruption Loan Scheme

- The Coronavirus Large Business Interruption Loan Scheme

- Business Recovery Loan Scheme (RLS)

Business Recovery Loan Scheme Calculator

The business loan scheme calculator is as follows:-

| Term | Interest Rate | Monthly Payment | Total Repayment |

| 1 year | 6.16% | £ 2,157.81 | £ 25,893.68 |

| 2 year | 6.16% | £ 1,112.04 | £ 26,688.92 |

| 3 year | 6.16% | £ 763.89 | £ 27,499.93 |

| 4 year | 7.06% | £ 600.55 | £ 28.826.45 |

| 5 year | 7.06% | £ 496.73 | £ 29,803.77 |

| 6 year | 7.06% | £ 427.80 | £ 30,801.58 |

Benefits & Features Under RLS

The benefits and features of this scheme are as follows:-

- A new scheme has been launched by the government of the United Kingdom to provide the facilities to the businesses for the recovery

- The name of this scheme is Business Recovery Loan Scheme

- Under this scheme, the maximum amount of facilities will be provided that is £ 10 M per business and £ 30 M per group.

- The minimum amount of loan under the UK Recovery Loan Scheme (RLS) is around £ 25,050 for term loans

- The term loans are available only up to 6 years

- Business week of the loan scheme will help businesses to meet their cost of interest and the fees that are associated with the RLS Facility

- The businesses that have taken from the other coronavirus schemes are easily able to assess the new schemes.

- But the amount which they have taken from the other scheme is limited

- Personal guarantees are not permissible for the facilities up to the amount of £ 250,000 or less.

- Above £ 250,000 the maximum amount that can be recovered is 20%

- The guarantee will be given to the lenders by the government against the outstanding balance of the facilities.

Eligibility Criteria

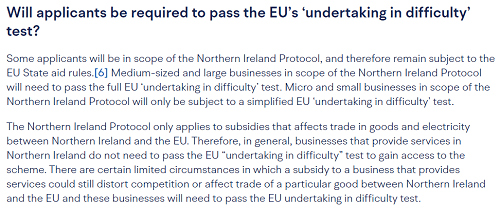

The following is the eligibility criteria to apply under this scheme:-

- An applicant must be a permanent resident of the United Kingdom

- He or she must be having trading in the UK

- The candidate must be viable or would be viable if it’s not for the pandemic

- The applicant must be negatively affected by the coronavirus pandemic.

Ineligible Criteria

The following is the ineligibility criteria for this scheme:-

- An applicant must have collectively insolvency proceedings

- An applicant who is a bank, insurer, and reinsurer

- The business who is the public sector

- State-funded Bank, primary or Secondary School

Important Documents

The important documents to apply under this scheme are as follows:-

- Business plan

- Management accounts

- Details of asset owned by the company

- Details of other business loan or overdraft

- Previous years accounts

- Details of personal loan mortgage overdraft and credit card debt

Process To Apply For Business Recovery Loan Scheme (RLS)

All the interested applicants who want to apply under this scheme will have to follow the procedure given below:-

- To apply for a business recovery loan is a name first of all you have to download the Application Form under British Business Bank.

- Now enter each and every detail which are asked in the form

- Attach all your important documents.

- After that, you have to submit this form to your lender which is accredited by the British Business Bank.

- The concerned department will go through your application form

- After the verification, the loan will be provided to the business.