Lead Bank Scheme 2024:- To provide banking facilities in the rural areas, the reserve bank of India has launched a new scheme known as Lead Bank Scheme. Under this scheme, the responsibility to act as a bank will be provided to the public sector banks in order to provide banking facilities in rural areas. In this article today we will share with you all the important information related to this scheme such as the objective, eligibility criteria, area of approach, and development. Also, we will share with you all this step by step application procedures to apply under the same scheme.

What Is Lead Bank Scheme 2024

A new scheme has been created by the Reserve Bank of India known as the Lead Bank Scheme. Under this scheme, the RBI will give the responsibility of providing adequate presence of banks in rural areas to public sector banks. The main aim of launching this scheme is to enhance the flow of bank Finance and the overall development of the ruler areas.

- The Lead Bank Scheme was introduced by the Reserve Bank of India in 1969.

- Under this scheme, the particular bank will be assigned as the lead Bank to deal with all the responsibilities of the district.

- It will help in distributing the bank services into the rural areas to promote Bank.

- The main role of Lead Bank will be provided to the private sector banks.

Key Highlight of Lead Bank Scheme 2024

| Name of the scheme | Lead Bank Scheme |

| Launched by | Reserve Bank of India |

| Country | India |

| Objective | Growth and Empowerment of Rural sector |

| Beneficiaries | Rural Sector |

| Benefits | Effortless Credit and finance opportunities |

| Facilities | Smoothen flow of Credit and Finance |

| First date for Application | Yet to be published |

| Last date for Application | Yet to be published |

| Mode of Application | Online Procedure |

| RBI Official Website | rbi.org.in |

Lead Bank Scheme Objective

The Reserve bank of India came up with the idea of developing Lead Bank in December 1969. The purpose of this scheme is to synchronize the banking task and other growing organizations in order to attain the target to increase the bank finance run to the preceding sectors to encourage the complete expansion of the rural sector. For this, one bank in the district will be given the responsibility to assist all the banks with the Lead Bank Scheme. The overall coordination of the banks will smoothen the credit and finance activities in the rural sector. The overall objective can be concluded as:

- This scheme aims to remove unemployment and to reduce underemployment.

- Opportunity for the poor to get the credit and finance to improve the living standard.

- It provides the essential needs for the weaker section of society.

Lead Bank Scheme Operated by

Lead Bank Scheme is operated by the Reserve Bank of India to Empower the poor of the Rural sector by Enhancing the functioning of Public Sectors Banks to have Uncomplicated Credit and Finance facilities. It was accomplished by the Study Group which recommended declaring one of the banks in the district with Lead Bank responsibility.

- The lead Bank is anticipated to manage the role of lead authority by coordinating with other banks and the working Government.

- The Lead Bank is also guided by the RBI to keep in mind the maximum involvement of Private Sector Banks.

Sukanya Samriddhi Yojana Interest Rate 2024

Development Of Lead Bank Scheme

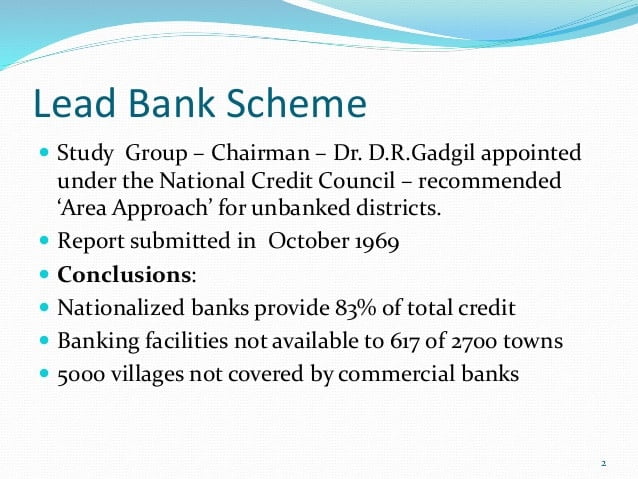

The development of the Lead Bank Scheme can be tracked to the study group led by Prof. D.R. Gadgil structured by the organization for the execution of Social Objective, which consents its reports in October 1969. The Study Group studied the certainty that Commercial Banks did not have enough existence in rural areas as well as needed rural inclination. The study group proposed the acquisition of the ‘Area Approach’ to develop plans and programs for the evolution of enough banking and credit implementation in rural areas. This Scheme was introduced by the Reserve Bank of India in 1969.

RBI Lead Bank Scheme

RBI governs Lead Bank Scheme amplifies the functioning of Banks in crediting and finance areas to strengthen the rural sectors. It includes various banks of the same district to participate in swift Banking activities for the approval of Credit.

- This Scheme will help the people of rural areas to live a life of standard.

- It will be an aid for unemployment and will assist the villages having underemployment.

Approach Area of Lead Banks

Lead Bank Scheme came up with the objective of development of Banking activities and Credit formats for the rural areas by creating an ‘Area Approach. It was considered for the Area Approach that districts will be acting as units and one of the districts will be assigned to the bank which would be responsible for fast banking activities in the district. The main area of approach under this Scheme is mentioned below.

Lead Bank As Consortium Leader

Different banks have been assigned by The Lead Bank scheme to work as Consortium Leader to provide the banking services in the rural areas of the district like expansion and credit planning. It will help in meeting the credit needs of the rural economy. And for this purpose, all the credit institution that is present in that area will act as Consortium Leader.

District Allotment

The responsibility to act as a Lead Bank has been given to all the districts in the country except the metropolitan cities of Mumbai Kolkata Chennai Chandigarh Delhi and Goa. After some time the union territories of Goa Daman and Diu have also taken into consideration The Lead Bank Scheme.

District Consultative Committee

For the successful implementation of this scheme, direct consultative committees have been created in all the districts to coordinate all the facilities of the bank and financial institute. The district consultative committee (DCC) has been constituted during the year 1971-73.

Direct Credit Plan

The other main area of approach under the Lead Bank Scheme is to implement the direct credit plan. These are the positive features that have been taken to cover all the credit gaps that are identified. The district credit plan was the star that was neglected and now it is the priority to provide credit to various sectors.

Village Adoption Scheme

The main aim of launching a village adoption scheme is to adopt the bank for the ruler areas which has not been chosen by the area approach before. The main aim of not choosing this scheme was to avoid the pitfalls of scattered and unsupervised landing. Now the RBI has ordered to adopt villages to avoid scattered landings.

Inactiveness Of Scheme

The following are the factors due to which the Lead Bank Scheme has become inactive.

- This Scheme was not able to achieve its target due to complexities operations and issues of shifting Financial institutes.

- The other main reason was the lack of coordination between the district and the banking institution. The empowering plan team at the district level should be needed for the better implementation of the system.

- The system of the Lead Bank scheme and the coordination committee of associated respect level leads to inactiveness of the scheme.

- Clear guidelines on the banker commercial judgment it has been needed for the strong implementation of this scheme which has not been taken.

- All the committee is like block-level bankers committee district coordination committee and district review committee has not to function with seriousness.

Important Point For Critical Examination

The points for critical examination are as follows:-

- There is an urgent need to revamp delete Bank scheme to make an effective bringing and coordination among Bank.

- This is scheme will help in greater participation of banks and financial institutions for achieving great financial inclusion.

- With the help of the Lead Bank Scheme of the ruler areas, people will be able to meet their day-to-day requirement of funds from the Bank.

- All banks must do the full computerization and data management to prepare and review reports early draught plans and financial inclusion plans from time to time

- There is a need of revamping the district-level consultative community to get a result-oriented organization.

- This scheme is an effective instrument that will help in bringing the involvement of all bank members in all efforts.